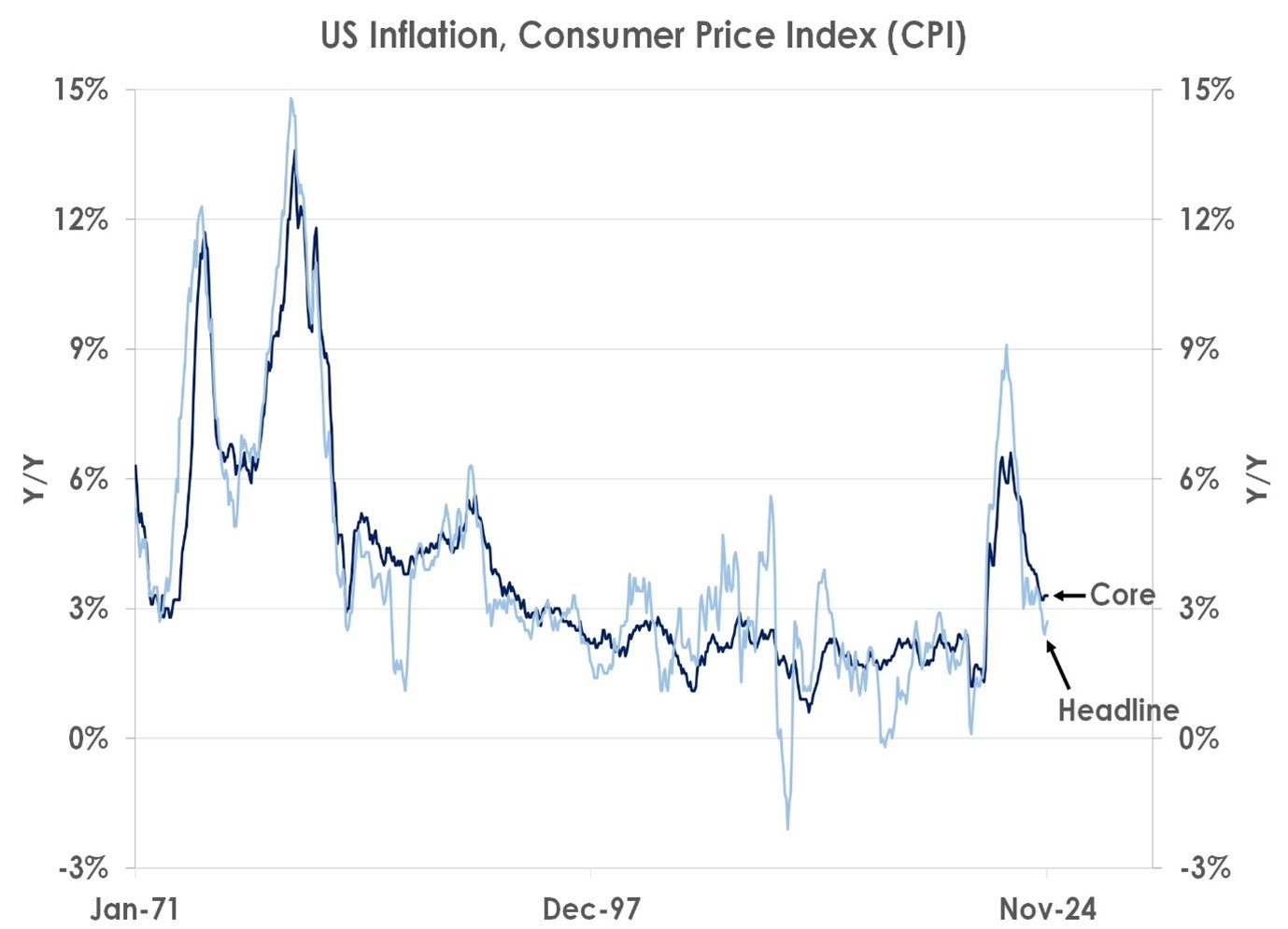

November’s US CPI was in line with expectations with overall and core prices - excluding food and energy - each rising 0.3% last month. Headline inflation now stands at 2.7% compared to its peak of 9.1% in 2022 - as the chart shows - and core inflation is at 3.3% versus 6.5% two years ago.

Source: Bank of Singapore, Bloomberg

We draw four lessons from the latest inflation data.

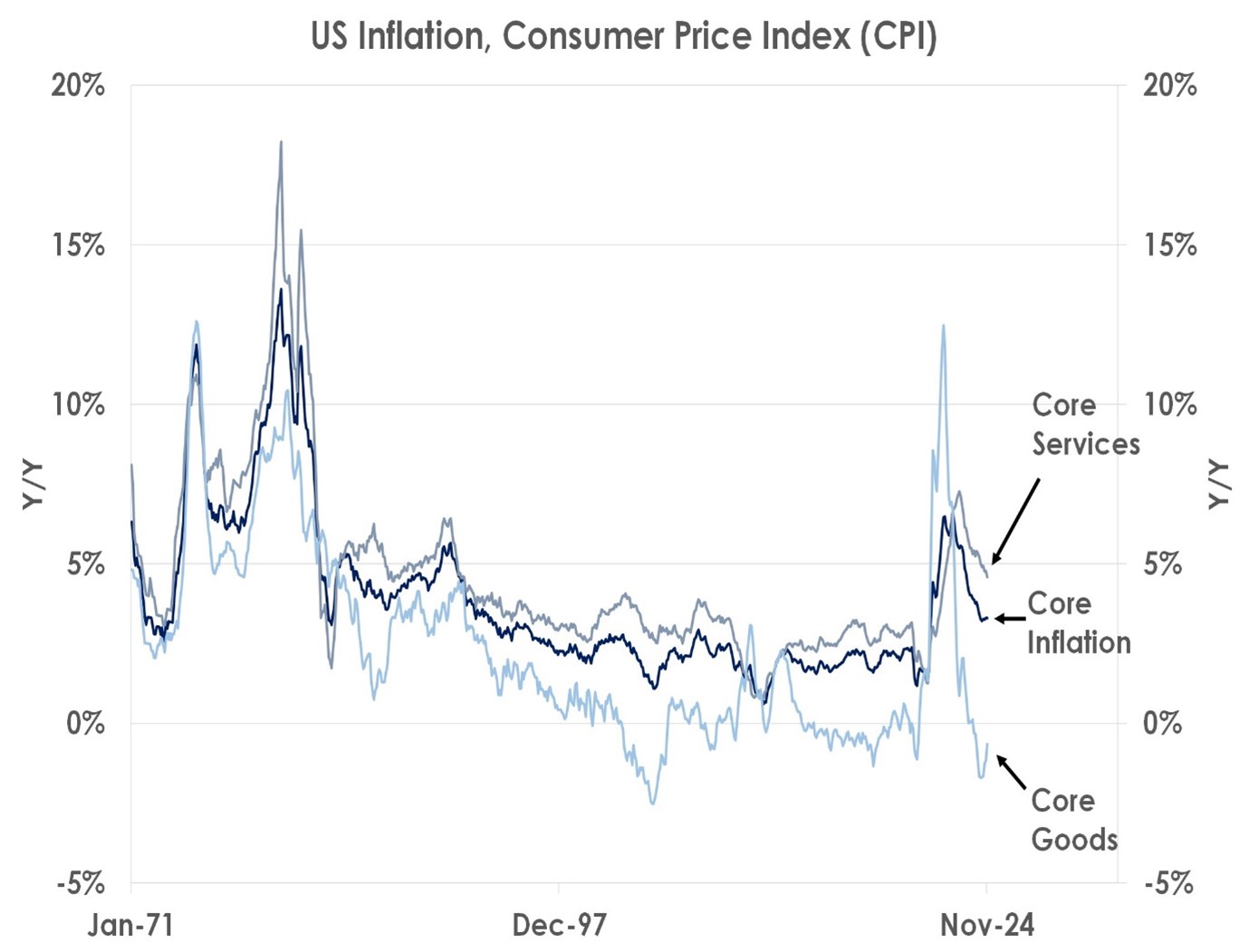

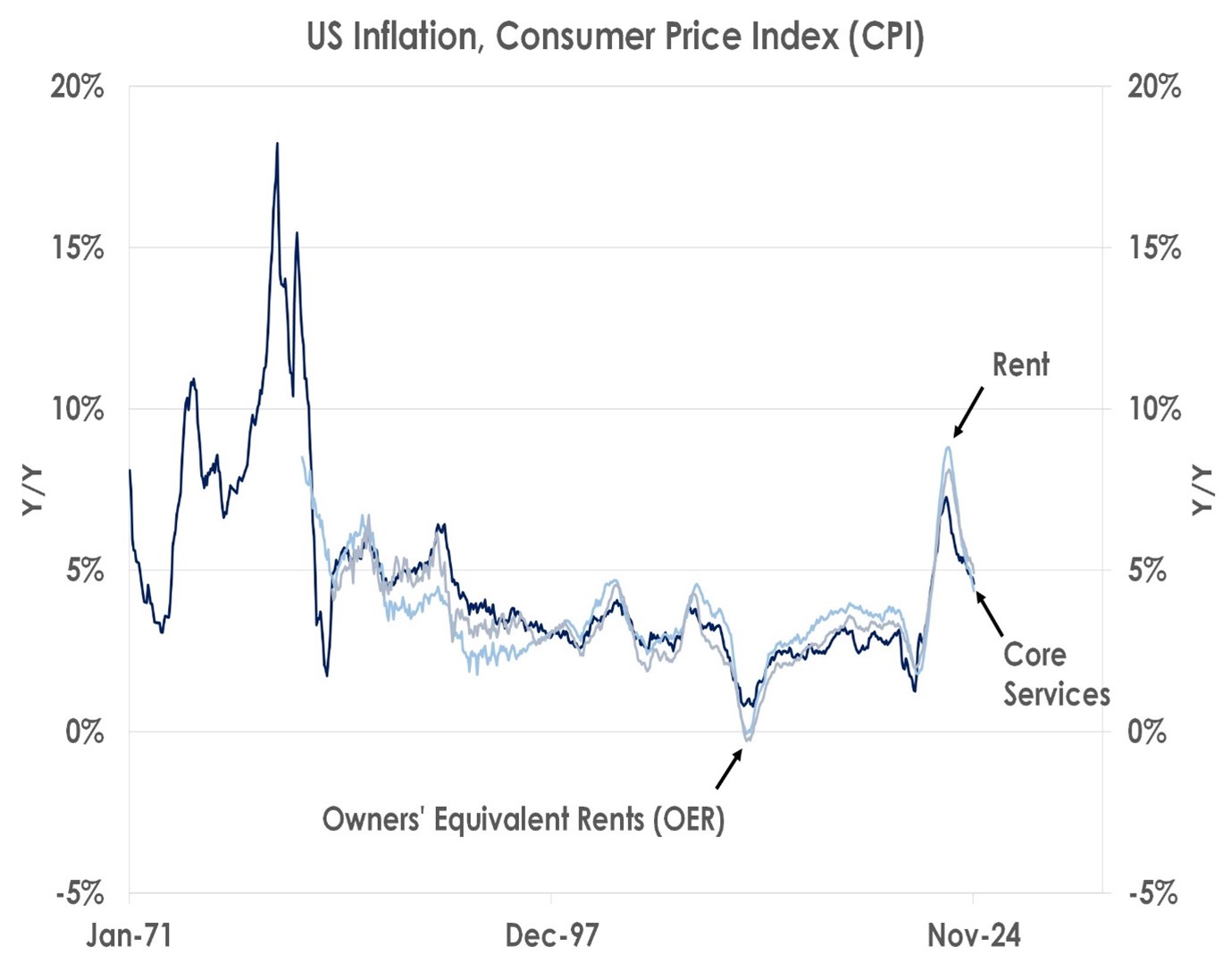

Firstly, the Federal Reserve is set to cut interest rates for the third meeting in a row by 25bps to 4.25-4.50% this month as underlying inflationary pressures keep gradually easing. The following charts show inflation in core services has dipped below 5.0% to 4.6% as tenants’ rents and the equivalent for homeowners each rose 0.2% last month, the lowest since 2021.

Source: Bank of Singapore, Bloomberg

Secondly, the Fed should still be able to deliver further rate cuts in early 2025 as falling rental inflation will keep lowering overall inflation. Fed easing, less regulations and potential tax cuts Iin 2025 should keep supporting equities.

Source: Bank of Singapore, Bloomberg

Thirdly, core inflation, however, is still likely to settle above the Fed’s 2% target even before US tariffs are raised. Last month, car prices jumped 2.0% and hotel costs by 3.8%. These items are more volatile than housing but after the pandemic, consumer prices keep surging suddenly. The Fed may thus need to stop easing by early 2025 with its fed funds rate still near 4.00%.

Lastly, we stay cautious on duration and favour the USD. 10Y UST yields may hit 5.00% if inflation stays sticky and the US budget deficit high.

This article was first published by Bank of Singapore on 12 December, 2024. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of OCBC Private Bank or its affiliates.

OCBC Private Bank provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC Private Bank is a part of OCBC Group.